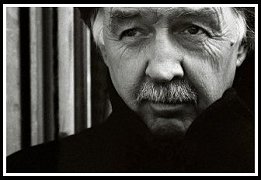

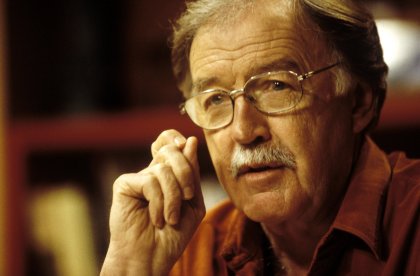

KEN FEINBERG (US CORPORATE WATCHDOG) – 11th April 2010

Back in the late '80s, when Michael Douglas prowled Wall Street as the

notorious Gordon Gecko, the Hollywood blockbuster movie was meant to be

a salutary lesson to the "greed-is-good" generation of high-flying

executives. What actually happened was that Gecko became the poster boy

for the corporate cowboys as they rewarded themselves with absurdly

excessive millions in bonuses and salary perks. Fast-forward to the

global financial crisis and the same sort of lunatic risk-taking that

saw the US - and the rest of us - taken to the very brink of financial

ruin. Now with the American economy slowly stabilising, propped up by

multibillion-dollar taxpayer-funded bailouts, Barack Obama is

apparently determined to curb corporate greed and excess. The man he

appointed to ride shotgun on that brave commitment is Ken Feinberg.

George Negus spoke to him from Washington.

GEORGE NEGUS: Ken Feinberg,

thanks very much for giving us your time.

KEN FEINBERG, US CORPORATE WATCHDOG: Glad to be here.

GEORGE NEGUS: Can you tell me why I have seen you described as

the most

hated man on Wall Street? What have you been up to that makes people

feel as strongly about what you're doing?

KEN FEINBERG: Congress passed a law, and the law said that the seven

companies that received the most taxpayer assistance during the

financial crisis shall have top official executive compensation

determined by a Treasury official.

GEORGE NEGUS: Are you getting anywhere because to all intents

and

purposes, it is still business as usual? That those bankers on Wall

Street and other corporate executives are still well reefing off a lot

of money - in this case, taxpayers' money?

KEN FEINBERG: It is certainly not business as usual with the seven

companies where I assert jurisdiction. Now, it is a very limited role,

I must say, but it is to those seven companies - cash compensation,

down 90%, overall compensation - cash and stock - down 50%. I would say

that it is to the limited number of companies where I have jurisdiction

there has been a sea-change in the way these executives get

compensated. Now, as to other companies on Wall Street, there are early

indications there has been some voluntary change.

GEORGE NEGUS: Do you have real clout though, or is it just

not-so-friendly persuasion that you are trying to exert over what a lot

of people regard as a culture of greed on Wall Street that led not just

America, but the world, into one of its greatest financial crises ever?

What can you really do to persuade them?

KEN FEINBERG: First, persuade. As to the seven companies - Bank of

America, Citigroup, AIG, GM, GMAC, Chrysler, Chrysler Financial - as to

those seven it companies last year, it was not persuasion. I had

statutory mandated authority to set the compensation. Now, it is true,

Citigroup and Bank of America repaid all of the taxpayers' assistance.

So, they are no longer in my jurisdiction.

GEORGE NEGUS: Is it the case that - this executive pay scandal

- if you

like, that's got right up the nose of American voters, of American

citizens? Are the executives' pay, pay outs, if you like, or what they

give themselves, is that a symbol or a symptom of a much greater

problem that goes way beyond Wall Street?

KEN FEINBERG: I think it is both. I have discovered on this job the

tremendous gap in perception between the way Wall Street thinks and the

way Main Street thinks in America. There is real, justifiable anger and

frustration over these excessive Wall Street bonuses, guaranteed

salaries, guaranteed commissions - regardless of performance - it is

these principles, or these characteristics of Wall Street, that we are

trying to influence and change.

GEORGE NEGUS: The President himself has said that if these

guys want to

fight, to paraphrase his words, then he will give them a fight. He

obviously feels very strongly about it. Is he likely, now that he has

succeeded with the health issue, to shift his attention to Wall Street

bankers - corporate executives generally? He's up for it, by the sound

of it.

KEN FEINBERG: I don't think he has shifted his attention. I think the

Administration has always considered excessive pay and Wall Street

reform as a top priority. There is legislation now pending in Congress

that has nothing to do with what I'm doing directly with a limited

number of companies involving regulatory reform and other initiatives.

I think that now that health care is successfully behind us, the

Administration is gearing up and focusing on the need to rein in some

of these excessive Wall Street practices.

GEORGE NEGUS: Warren Buffett, who is actually not a poor

American

himself, has been pretty tough on this whole situation. He actually

says these guys should pay a heavy price. You say that you are not

vengeful but what price should the bankers and the financiers be paying

for this to have got not just America, but the rest of us, into this

difficult situation?

KEN FEINBERG: Look, the seven companies that I have been dealing with,

they are owned by the American people. They survived financially

because of taxpayer assistance. It is only appropriate under the

statute that the taxpayers, who are actually the creditors of these

companies, have an influence and a direct say on what the top officials

get paid. It is not vindictiveness, it is not revenge, it is simply a

fact of life to these limited number of companies.

GEORGE NEGUS: Ken, if I can ask you this, at a personal level,

when you

sit down and talk to these guys, who think that they of probably

fulfilling the American Dream by grabbing whatever amount of money

seems to be available to them, how do they react to you when you talk

the way you are talking now to me? I wouldn't imagine they would like

it very much.

KEN FEINBERG: They don't get it. They don't get it. And I try and

explain to them that I am mandated by law to curb excessive pay

practices. They can either cooperate, or not cooperate. There is very

little sentiment or support for their position in the United States,

and I venture to say, Australia as well.

GEORGE NEGUS: Are you hitting right at the very heart of what

the

American economy, and almost the American ideology is, that these guys

feel they have every right to do what they are doing? And you are

talking about mandated authority, you are talking about regulation.

Isn't regulation, to the American banker, tantamount to America

shifting wildly the to the left to have their market, if you like,

regulated?

KEN FEINBERG: I don't think so. First of all, I have to repeat, my

mandate is very narrow. I have a limited number of companies. There is

absolutely no sentiment in Congress, or with the Administration, to

expand my role. My role is limited. I must say that the effort to

impose new restrictions on Wall Street is not a sharp swing. It is a

recognition over the last few years that deregulation and the free

market went too far and as a result, the American people are paying the

price.

GEORGE NEGUS: You could say the free markets have actually

become,

where America is concerned, not free, but very expensive in the fallout

from the GFC.

KEN FEINBERG: Well, it has been very expensive, and the taxpayer - the

men and women on Main Street - are supporting and propping up these

companies and that does not sit well with the Administration, with most

of Congress - this is not a partisan issue - this is a bipartisan

issue.

GEORGE NEGUS: Ken, with your involvement at that intimate,

day-to-day

financial level, what have we learnt, or what should we have learnt

from the GFC? What have we learnt?

KEN FEINBERG: From my perspective, we have learnt that guaranteed

compensation - unrelated to performance - guaranteed retention

payments, automatic commissions, short-term ability to cash in stock,

all of these practices have promoted a culture on Wall Street that

promotes excessive risk-taking. And everybody pays the price for that

globally. So, what you are seeing now, at least what I am doing in my

limited way - low-base cash salaries, no guaranteed compensation,

compensation tied to long-term performance. Your company thrives, you

will thrive. If the company falters, your compensation will be

diminished. These are the principles that I am trying to effectuate.

GEORGE NEGUS: In other words, earn your money, don't just take

it?

KEN FEINBERG: I like the way you said it.

GEORGE NEGUS: Ken, we could talk for the next couple of hours.

Thank

you very much for your time and all the best with your 'banker

busting', if you like.

KEN FEINBERG: Thank you very much for having me.

GEORGE NEGUS: Barack

Obama's pay czar, Ken Feinberg. And in case you were wondering what

he's up against, the top 10 CEOs on Wall Street still earn a measly

$20-odd-million a year each! Up next - we're off to the Everglades and

an unlikely threat to the local wildlife. The easiest spot is to shoot

'em in the head so you don't ruin the hide or the meat or anything.